Whenever I read a success story or see an amazing talent in action, my first thought is how gifted they are. To reach their level of success they must have some unique ability that the average person does not.

This is true, but not in the way I describe it. The gift they have has nothing to do with their profession. It has everything to do with the amount of time, effort and focus they put into their craft. As this work compounds, or builds on itself, their results pull away from the pack. Their success seems to come out of nowhere.

John Hayes, a cognitive psychology professor at Carnegie Mellon University studied this phenomenon. He wanted to know how long it took composers to create great works of art.

He started with the top 500 pieces created between 1685 and 1900. Next he mapped out the careers of each composer. He wanted to calculate how long each composer worked before creating a popular piece.

He found that 99% of the pieces were all created after ten years of work. Each composer needed a decade of practice to find success. Watching from the sidelines, these composers would come out of nowhere and be an overnight success.

Professor K. Anders Ericsson reinforced this research. He found you needed to put in at least “10,000 hours” to become an expert in a field.

To the person doing the work or to the spectator, the effort looks rather ordinary. No one practice session is going to turn anyone into an expert in anything. Yet, put in the time, day after day, week after week, month after month and the results start to build on themselves.

This is compounding. The idea is best known in the financial world and it’s called compound interest. You start with an investment, it grows and that amount becomes the new starting point. The next time it grows, it starts with that total vs. the original amount.

It’s time for a test. I will give you a penny a day doubled for a month or I’ll pay you $500,000 right now. What would you take? If you said $500,000 you’d be wrong. Doubling that penny for 31 days turns into more than $17,000,000.

But here’s the thing. After ten days the amount is less than $10. The process seems slow, almost like there are no results. In fact, it takes twenty six days to reach the $500,000 mark. And then the magic starts. In the last five days, you earn more than $16,500,000!

Keep in mind, there is no investment that doubles everyday. But the example helps make a point. Patience and consistency over time creates amazing growth. This is true in finances and in life.

When I was twenty-one I had my whole life in front of me. Retirement was the last thing on my mind. Lucky for me, someone taught me this lesson and I started to invest for my future.

At the beginning, I wasn’t investing much, but I was building a habit. I didn’t know it then, but the most important thing about compounding interest is time.

Take two people, Sally Saver and Steve the Spender. They each invest the same amount, month after month for 40 years. Sally starts at age 20 and Steve starts at age 30. At the end, Sally will have invested a third more than Steve but end up with twice as much money.

When it comes to compounding anything, time is a friend. Unless, the thing that is compounding is debt. This is scarier than any heart-dropping ride or monster I can dream of.

After I graduated college, I took a 4 week trip to Australia, New Zealand and Fiji. It was an amazing time. Since I was fresh out of school, I didn’t have any money. If I wanted to take the trip I had to put everything on a credit card.

At the end of 4 weeks I had racked up $5,000 in credit card debt. Lucky for me, I paid this off in the first few months, thanks to my new job.

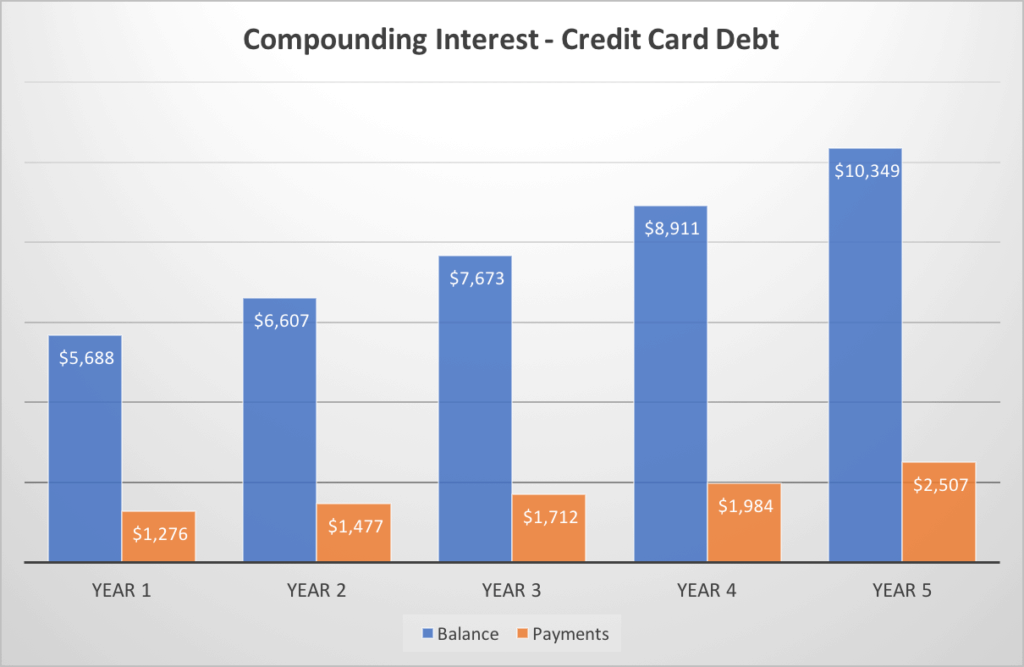

Let’s imagine I took a different route and paid the minimum fee every month. This varies from card to card, but for my example we’ll use 2% of the total amount owed.

In the first month, I would pay about $100. At the end of the first year I will have paid back about $1,276. But here’s the kicker, my original $5,000 total is now almost $5,700.

Fast forward to the end of year five. I will have paid almost $9,000 to the credit card company and still owe over $10,000. This is compound interest working against me. Paying the minimum is the same as being in jail. There is no escape.

Aristotle once said “We are what we repeatedly do.” If I want to be a millionaire, one way to get there is to invest month over month for as long as I live. If I want to be healthy, I need to keep putting good food in my body and exercise every week.

Being consistent with small things leads to big things down the road. The key is consistency. But, this is where most of us fall down.

Everyday we face choices. Go to the gym or sit on the couch? Practice free throws or play video games? Read a book or watch Netflix? Invest or spend?

We all know the right choice. But too often, immediate gratification takes hold and forces us down the wrong path. It’s happened to me more times than I can count.

While this is hard, it’s also an opportunity. Most people fail this test. Choosing the right path more often than not will put those that pass in the lead. The result looks like overnight success, but it will take at least 10 years.

This post is part of a series of letters to my kids. My goal is to reflect on and capture as many life lessons as possible. Here is the current list I am working from.